Hey all - just a quick note before getting to the meat of the newsletter.

I'm closing registration to my fundraising accelerator program in 11 hours (@midnight PST). It's the last program of the year so consider it for Q4 or Q1 fundraises - fundraisewithconfidence.com

…and now on to this week’s content for 9.6.22

Don’t waste time chasing investors. Do this instead

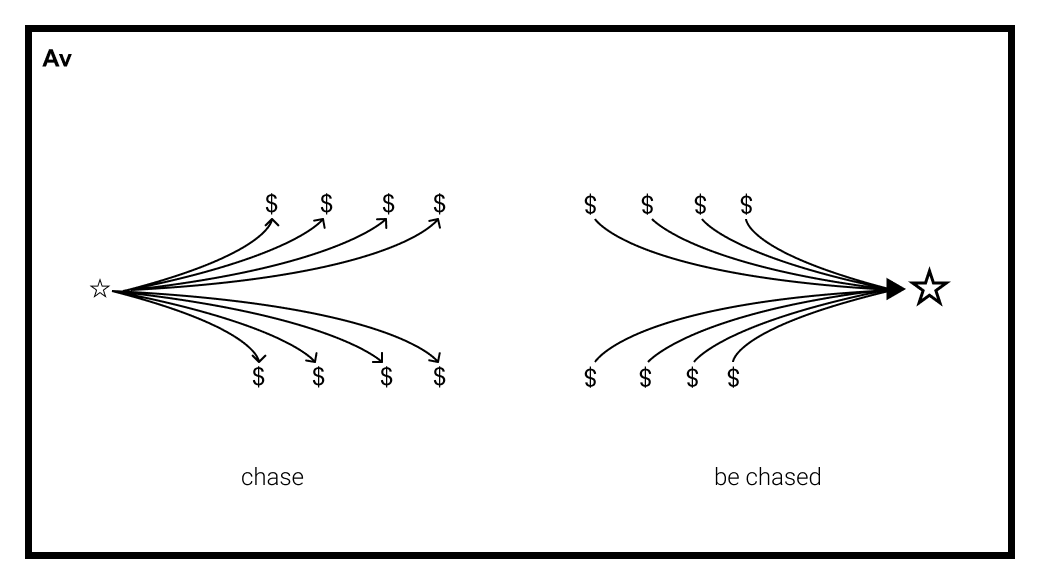

If you’re chasing investors…you’ve already lost.

I sign off every one of my newsletters with the declaration “...be chased.”

A common reaction to that is “ok, but how??” How do you attract investor attention without appearing needy?

Investors receive all types of dealflow on a daily basis. There are referrals, cold outreach, discovered opportunities… How does a founder stand out from the crowd and make investors see them as an awesome opportunity?

The answer is straightforward (but not necessarily simple). You make them feel like they’re “catching a deal.”

The goal is to make sure a VC feels like the deal they’re seeing is a gem emerging from the superior deal flow they’ve created as opposed to a dud that’s been passed over by others.

I was happy to partner with Knowable to take a deep dive into this subject and teach founders how to catch investors’ attention without chasing them.

Here are some key takeaways:

1. Produce and share valuable content

Create broader surface area for you and your company to be discovered. Do you have expertise that you can share and bring value to a broader audience? Establishing yourself as a thought leader in your industry takes time and commitment, but it’s one of the best ways to extend your reach beyond your immediate network and get on the radar of potential investors. People who start engaging and finding value in your content may be the source of valuable warm introductions later on.

2. Connect with founders in the VC’s portfolio

You’ll find that VCs are much more receptive to intros from founders in their portfolio than cold emails and LinkedIn messages. Chances are that your unique background, insights and experiences building your company can also be valuable to other founders. Think deeply about how you can provide value to others before you make any kind of ask. First, look through a target investor’s portfolio for companies that would likely benefit from a conversation with you. Offer your help and genuine interest in their company or story, and ask about their experiences with fundraising in general. Don’t ask for an intro right away- a half-assed endorsement doesn’t do anyone good. Instead, work on building a mutually beneficial relationship first, demonstrate why you and your company are a great bet, and that founder will feel like they’re doing the investor a favor by introducing you to them.

3. Ask for advice, not money

VCs want to meet you when you’re early on in the journey and they feel like they can “catch a deal” before you’ve started fundraising in earnest. One of the most powerful signals you can give is that you’re not desperate for money, and that raising money isn’t at the top of your mind. When you ask for thoughtful and actionable advice, it demonstrates that you’re hustling to refine your strategy, gathering valuable input, and building valuable relationships- NOT begging for money.

Want to learn more? Listen to my audio lessons on Knowable for free!

Smart Twitter Takes

Great to read through. Remember that each of these things are not a “slide” on its own necessarily. It’s just information investors hope to uncover

-----------------------

Useful data to check your target valuations against:

P.S. Haha. yes

|